Is Yrefy Legit? A Comprehensive Guide for Borrowers

Navigating the world of student loan refinancing can be overwhelming, especially with so many options available.

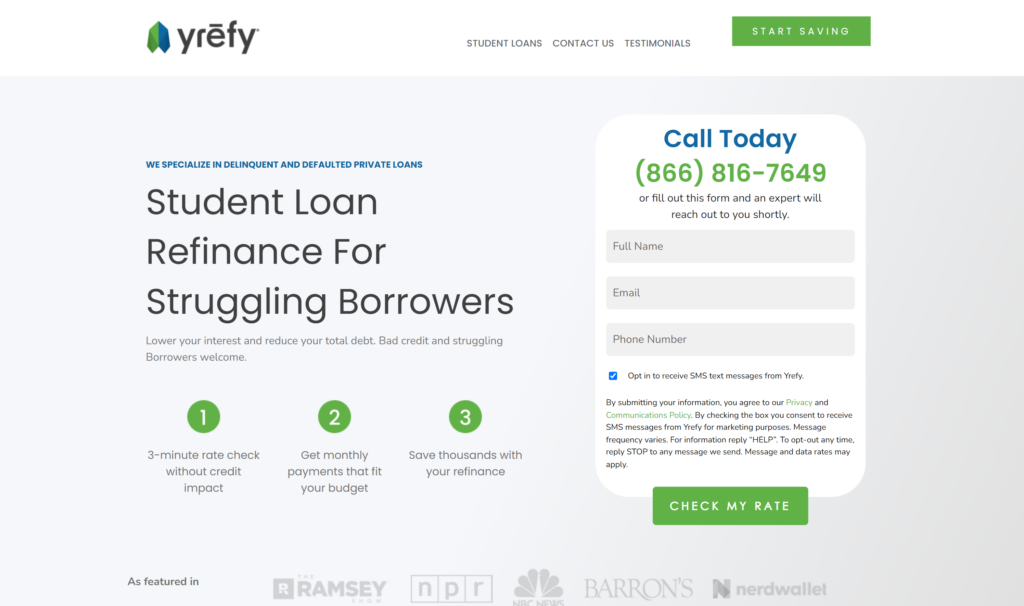

One company that often comes up in discussions is Yrefy, a lender specializing in refinancing distressed private student loans. With so much at stake, understanding whether Yrefy is a legitimate and reliable option is crucial for potential borrowers.

In this blog post, we’ll explore Yrefy’s offerings, address common concerns, and help you decide if it’s the right fit for your financial needs.

What is Yrefy?

Yrefy is a private student loan company focused on refinancing loans that are delinquent or in default. Unlike many traditional lenders, Yrefy specifically targets borrowers struggling with private student loans, offering them an opportunity to regain financial stability.

Their services include providing lower interest rates and more manageable monthly payments, even for borrowers with less-than-perfect credit.

Who Owns Yrefy?

Yrefy operates under the umbrella of Yrefy LLC. While specific ownership details are not widely publicized, the company is known for its emphasis on ethical lending practices and helping borrowers who face difficulties with their student loans.

The leadership team comprises experienced professionals in the finance and education sectors, aiming to provide solutions tailored to borrowers’ needs.

How Does Yrefy Work?

If you’re considering refinancing with Yrefy, understanding their process is essential. Here’s a step-by-step guide to how Yrefy operates:

1. Initial Consultation and Eligibility

Yrefy begins with a soft credit check to assess your financial situation without impacting your credit score. They evaluate factors beyond just your credit score, such as your willingness to repay and overall financial health.

2. Application Process and Credit Checks

If you meet their initial criteria, Yrefy proceeds with a hard credit inquiry, which may temporarily affect your credit score. You’ll need to provide financial documents, including proof of income and loan details, to support your application.

3. Loan Terms and Interest Rates

Upon approval, Yrefy offers refinancing options with fixed rates averaging around 3.9%. Loan terms can extend from 3 to 15 years, depending on your financial needs and the amount refinanced.

4. Finalization and Payment Processes

Once you accept their offer, you’ll pay a 5% origination fee based on the loan balance. Yrefy then disburses funds to pay off your existing loans, and you begin repayment under the new terms.

Is Yrefy Legit?

Yes, Yrefy is a legitimate company. They are accredited by the Better Business Bureau (BBB) and operate in compliance with industry regulations.

Customers have reported positive experiences, especially those who struggled with defaulted loans and found relief through Yrefy’s refinancing programs. Additionally, Yrefy’s focus on ethical lending and helping distressed borrowers sets it apart from many other lenders.

Is Yrefy Real or a Scam?

No, Yrefy is not a scam. The company has a solid track record in the student loan refinancing market, with a growing presence on reputable financial platforms and consumer reports.

Yrefy has received endorsements from notable financial advisors, further establishing its credibility and legitimacy in the industry.

Benefits of Using Yrefy

Yrefy offers several advantages for borrowers considering refinancing:

1. Competitive Interest Rates

Yrefy’s fixed rates, averaging around 3.9%, are competitive, especially for borrowers with defaulted loans. This makes monthly payments more affordable.

2. Specialized Services for Distressed Loans

Yrefy caters specifically to borrowers with private student loans in default, offering tailored solutions that many traditional lenders do not.

3. Positive Customer Testimonials

Many borrowers have shared positive experiences with Yrefy, highlighting their professionalism and willingness to negotiate favorable terms.

Possible Risks and Considerations

While Yrefy provides many benefits, there are potential drawbacks to consider:

1. Long-Term Financial Implications

Extending your loan term may lower monthly payments but could result in paying more interest over time. It’s important to weigh these costs against short-term relief.

2. Origination Fees

Yrefy charges a 5% origination fee, increasing the total loan balance. Comparing this fee with other options is crucial.

3. Credit Score Effects

The initial hard inquiry can temporarily lower your credit score, but making timely payments can help rebuild it over time.

Yrefy Investment Opportunities

Apart from loan refinancing, Yrefy also offers investment opportunities for accredited investors. Here’s what you need to know:

1. Investment Returns and Risks

Yrefy provides a guaranteed return of 10.25% to investors, supported by interest payments from borrowers. However, as with any investment, there are associated risks.

2. Ethical Lending Alignment

Yrefy’s business model involves purchasing distressed loans at a discount, allowing them to generate returns while helping borrowers achieve financial stability. This aligns with their commitment to ethical lending.

Final Thoughts

Yrefy plays a vital role in the student loan refinancing arena, providing solutions for borrowers with distressed loans. Their legitimacy and ethical practices make them a viable option for those seeking financial relief. However, it’s crucial to evaluate the potential risks and long-term implications before committing to their services.

If you’re considering Yrefy’s offerings, take the time to explore their services further and consult with financial experts to ensure it aligns with your goals.

FAQs

How long has Yrefy been in business?

Yrefy was founded in 2017, making it a relatively new player in the student loan refinancing market.

Is Yrefy FDIC insured?

No, Yrefy SLP4, LLC is not FDIC or SIPC insured. It operates as a Regulation D 506c offering for accredited investors.

What does Yrefy do?

Yrefy specializes in refinancing distressed private student loans, excluding federal student loans.

Is Yrefy a good investment?

While Yrefy offers attractive returns, potential investors should carefully consider the associated risks and consult financial advisors before proceeding.

How can I apply for refinancing with Yrefy?

To apply, contact Yrefy for an initial consultation and gather necessary financial documents. If eligible, proceed with the application and credit checks.